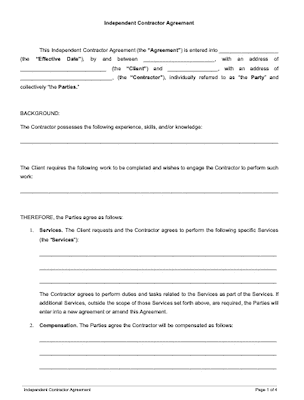

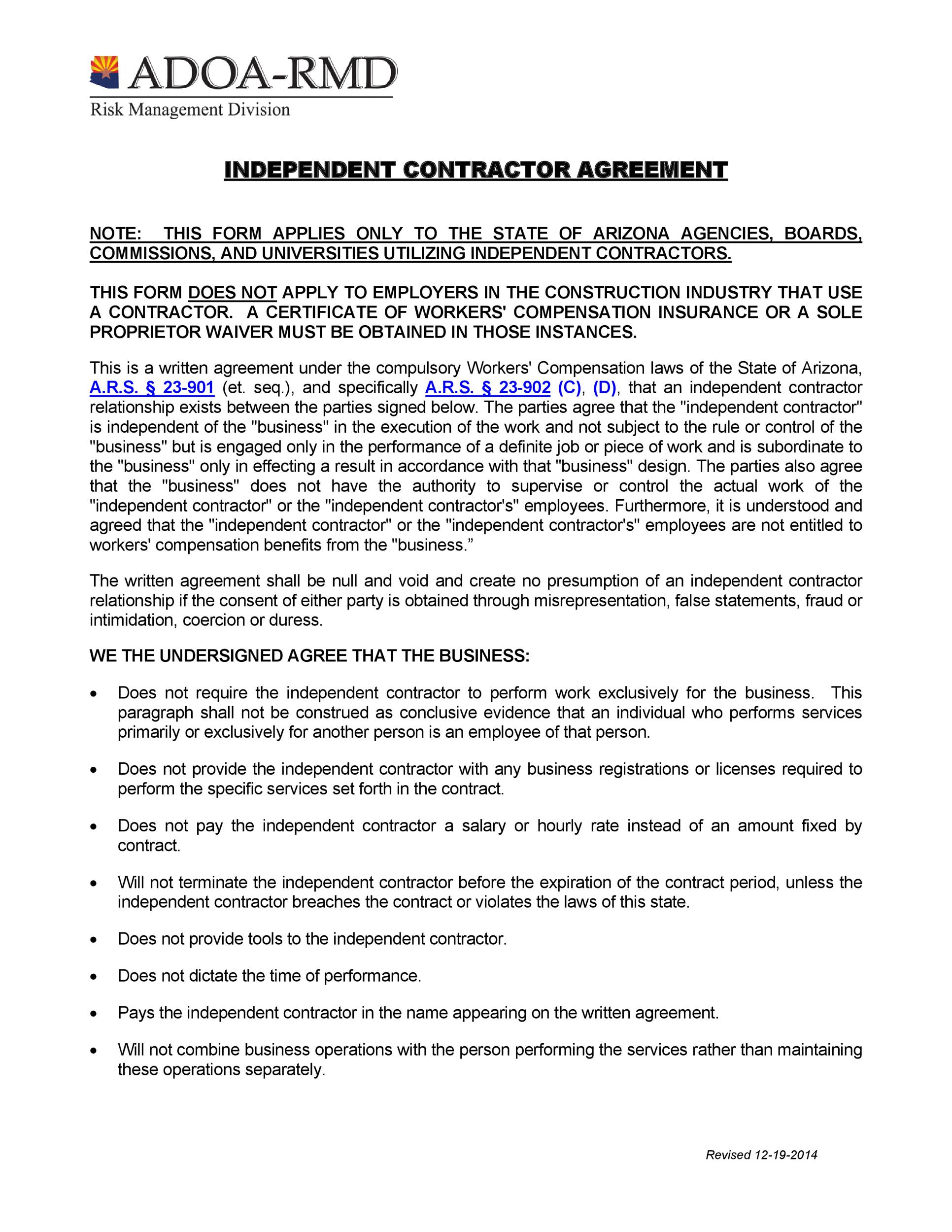

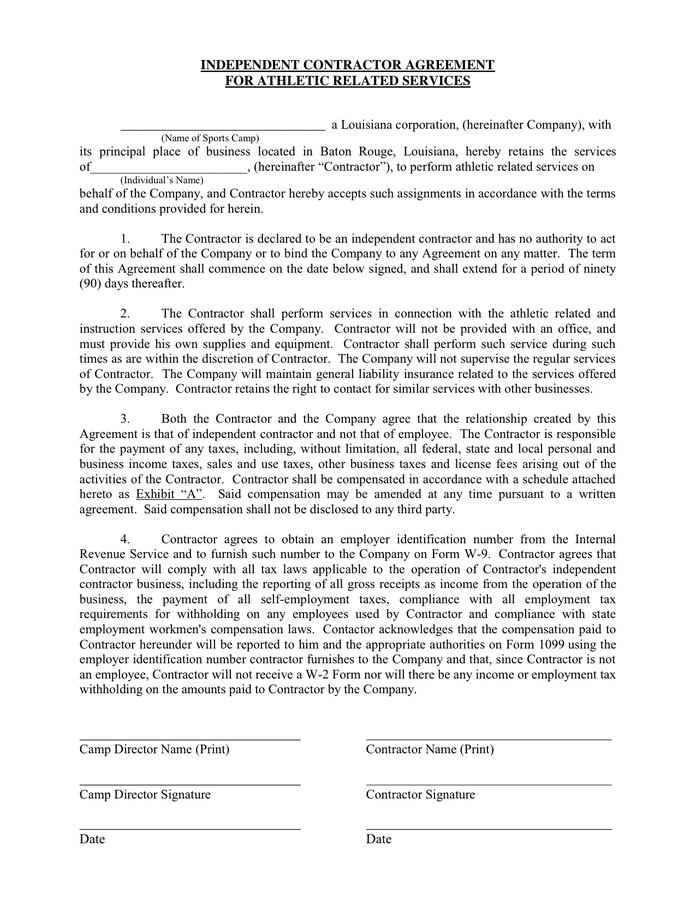

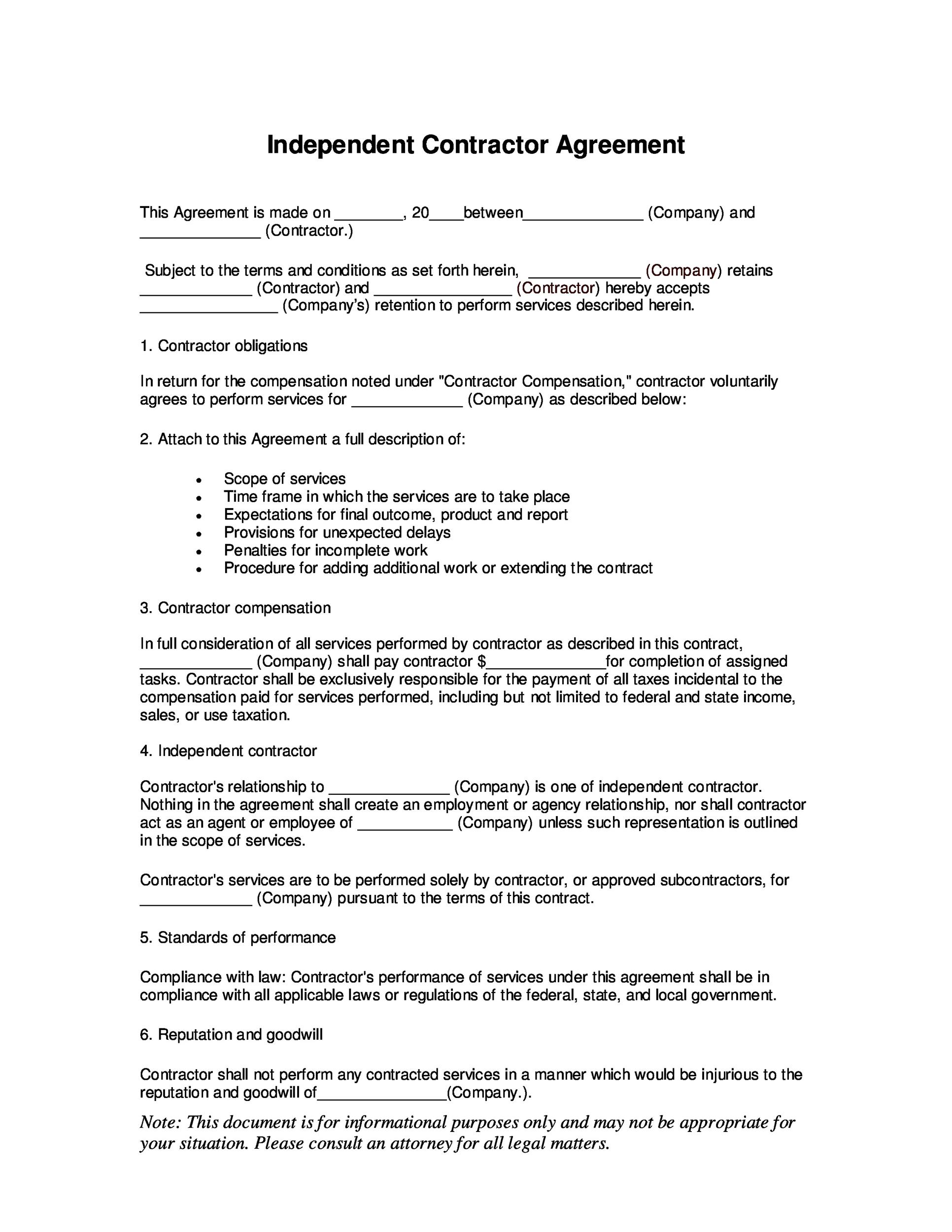

Feb 11, 17 · What is an independent contractor agreement?Jun 23, 19 · 1099 Form Independent Contractor Agreement Timeline Template Pertaining To Simple Contract Agreement Contractor Form 1099 1099 Contractor Form Pdf W 9 Form For 1099 Contractor Irs Form 1099 Independent Contractor 1099 Contractor Form 17 Irs 1099 Misc Independent ContractorJan 19, 09 · this is an agreement for independent contracting services the contracting party provides no benefits such as unemployment insurance, health insurance or worker's compensation insurance to independent contractor contracting party is only interested in the results obtained by the independent contractor independent contractor shall be responsible for providing all

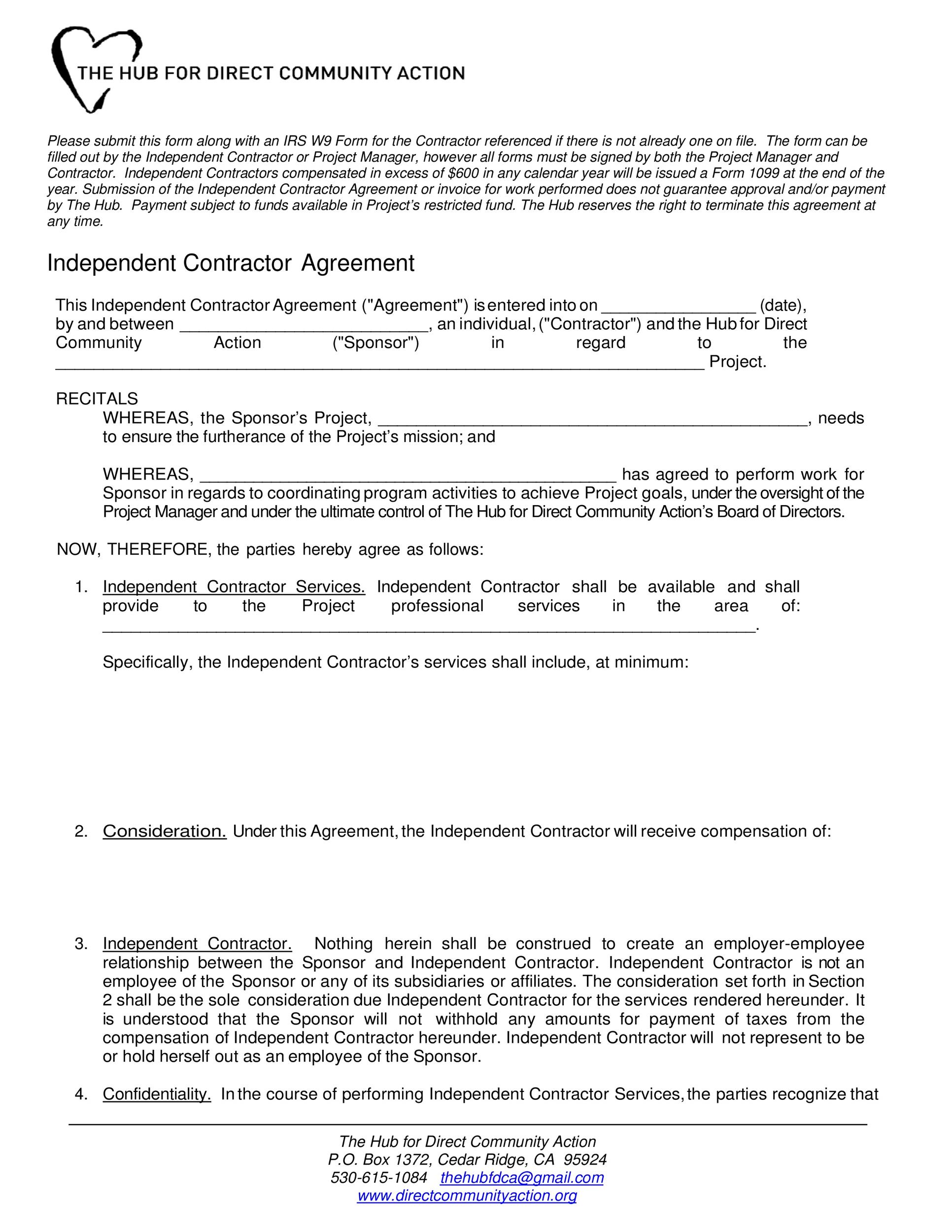

Free Printable Independent Contractor Agreement Template Templateral

What is 1099 contractor agreement

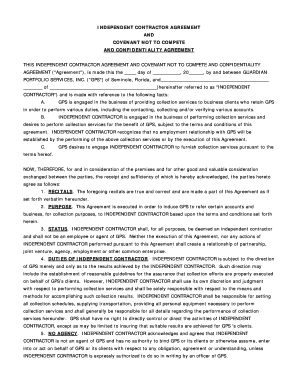

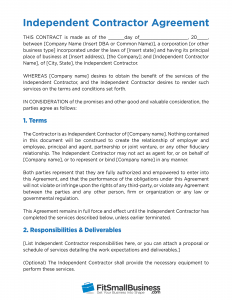

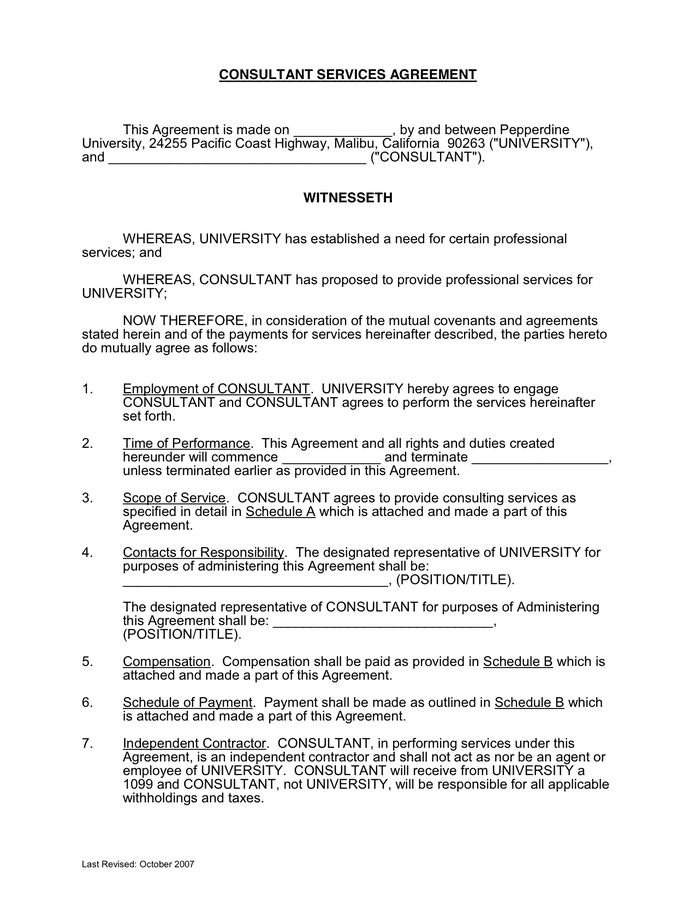

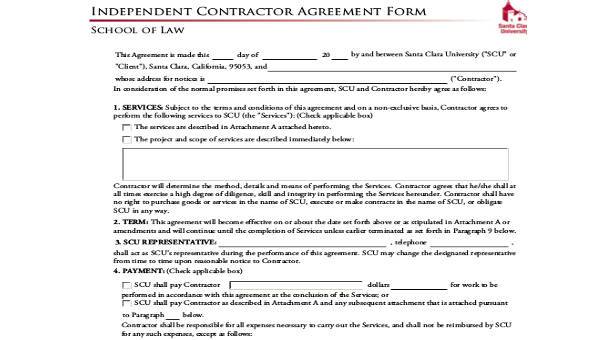

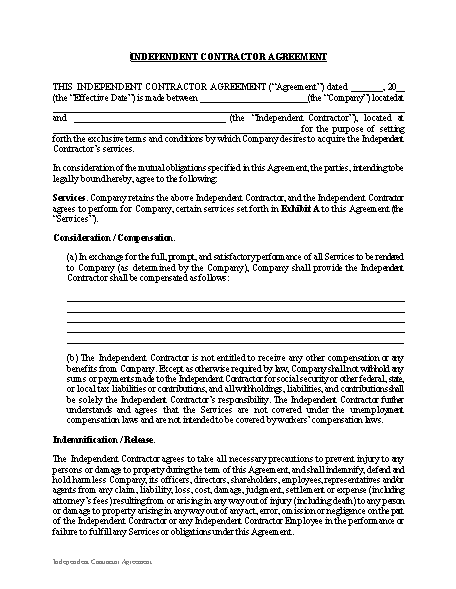

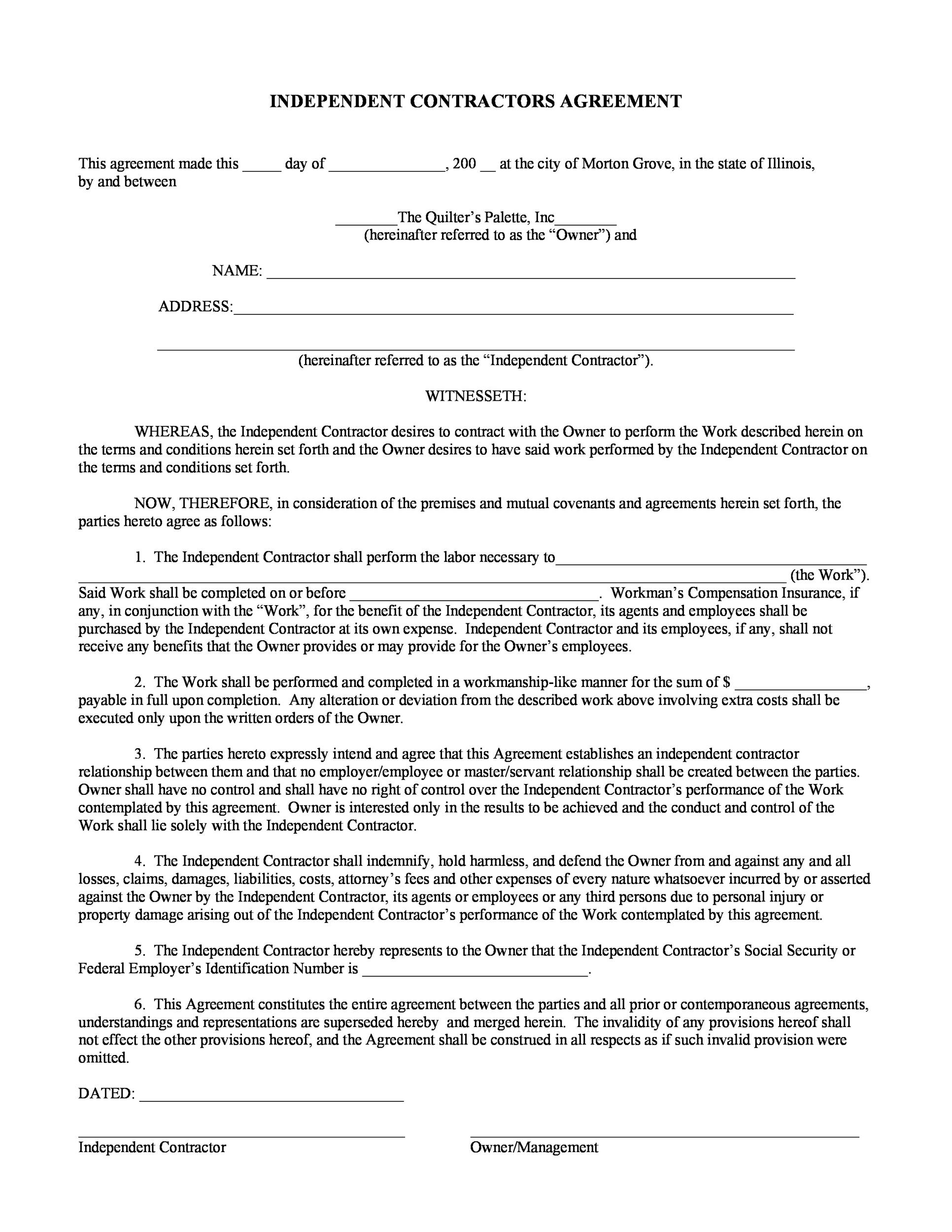

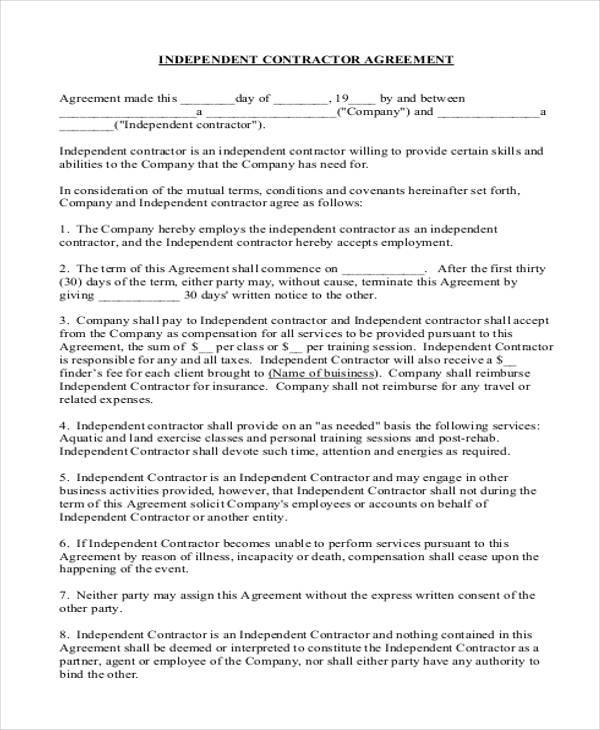

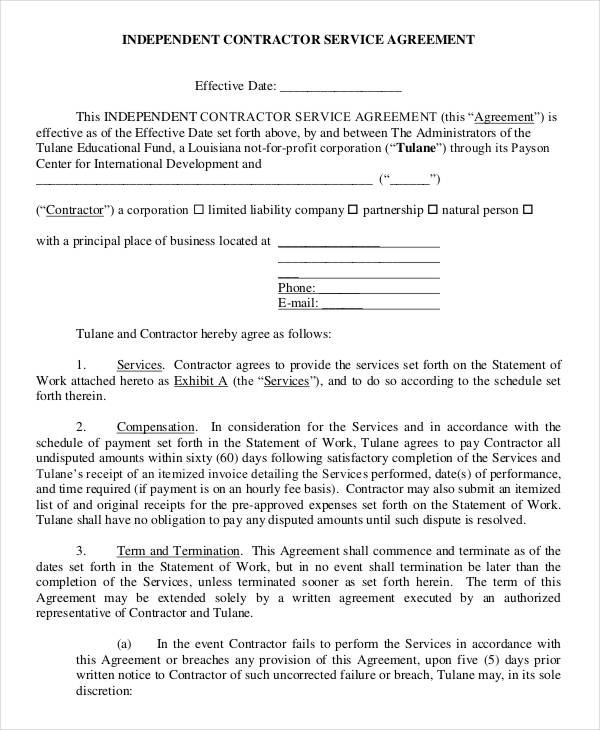

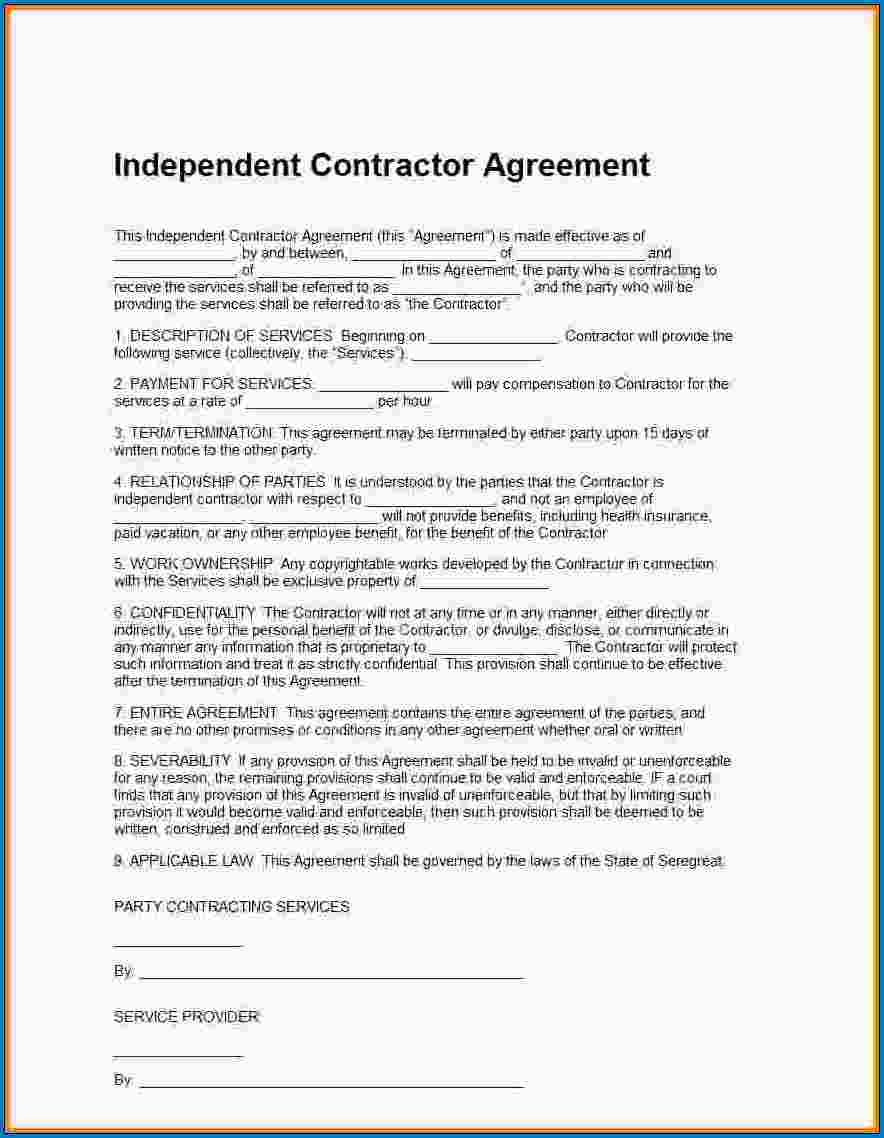

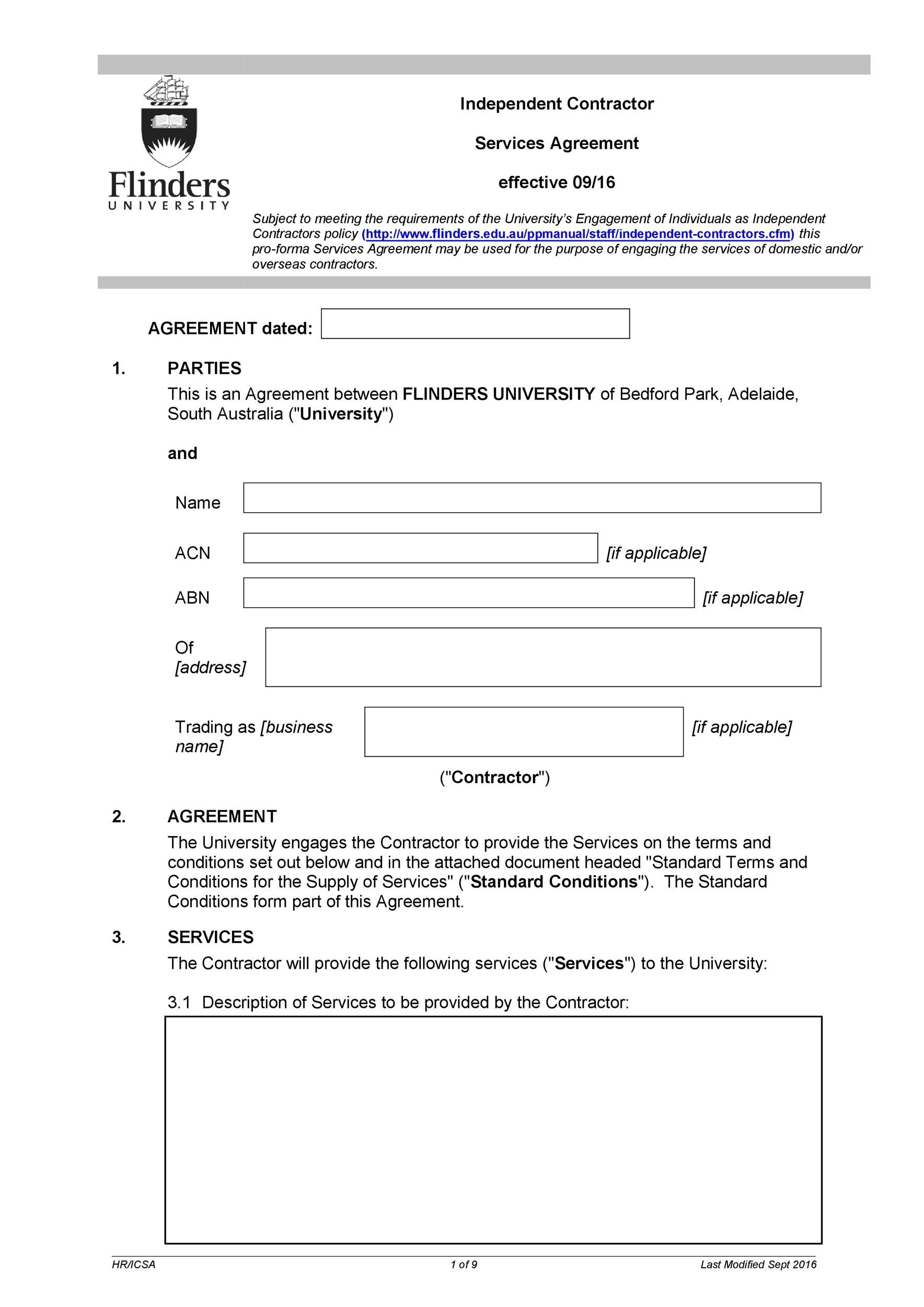

What is 1099 contractor agreement-Independent Contractor Indemnification The parties understand and agree that this Agreement is not a contract of employment in the sense that the relation of master and servant exists between District and Republic or between District and any employee of Republic Republic shall, at all times, be deemed to be an independent contractorAn independent contractor agreement is an important agreement for both someone hiring an independent contractor and the person who will be working as the contractor The agreement should outline what the work entails and what kind of payments will be rendered for services

Independent Contractor Agreement Full Time

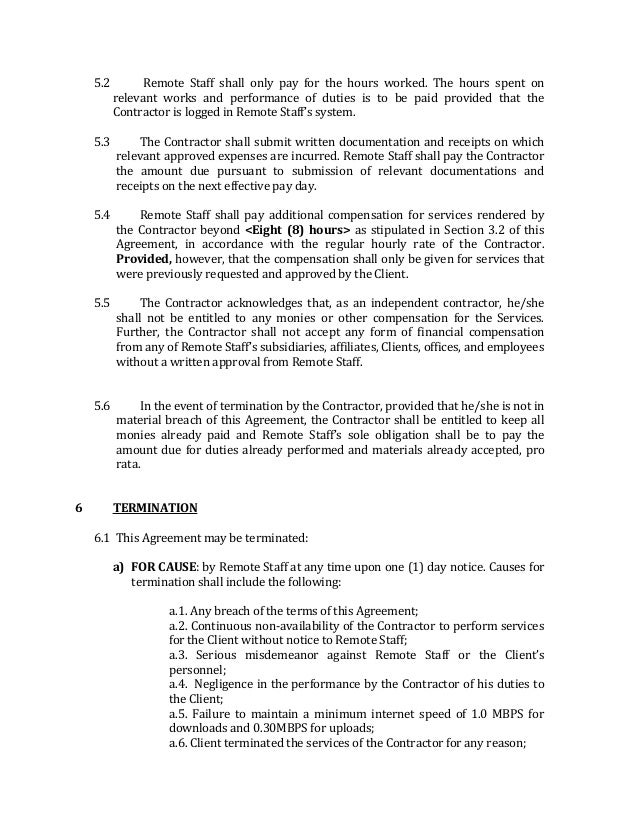

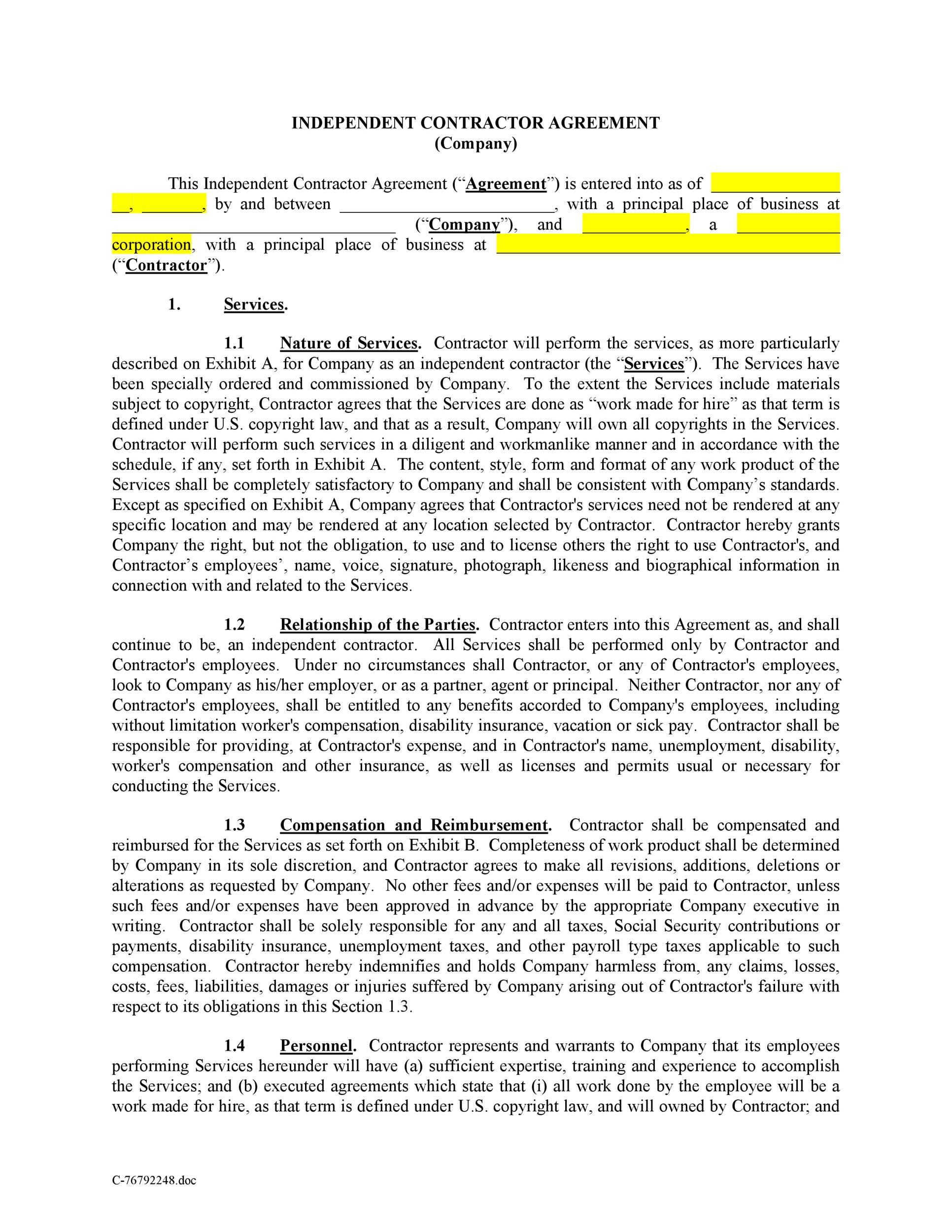

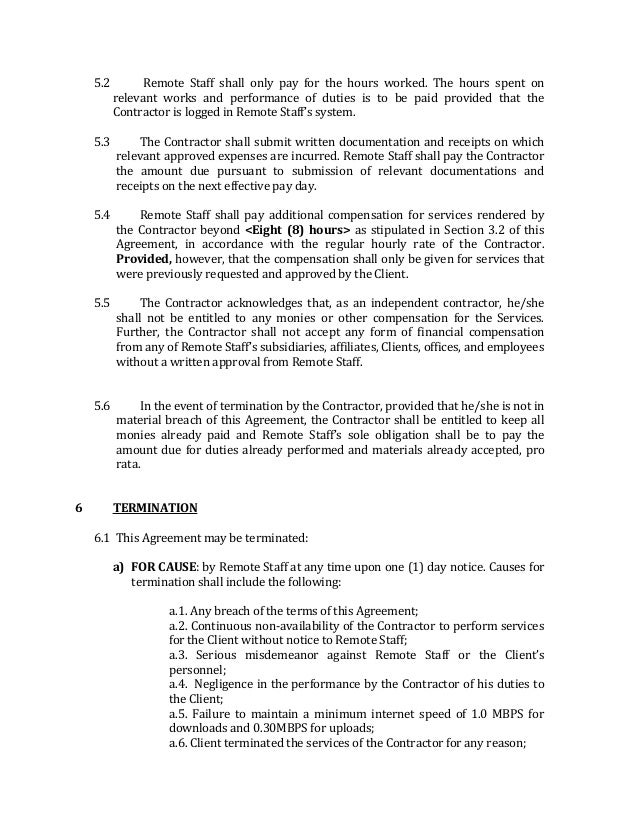

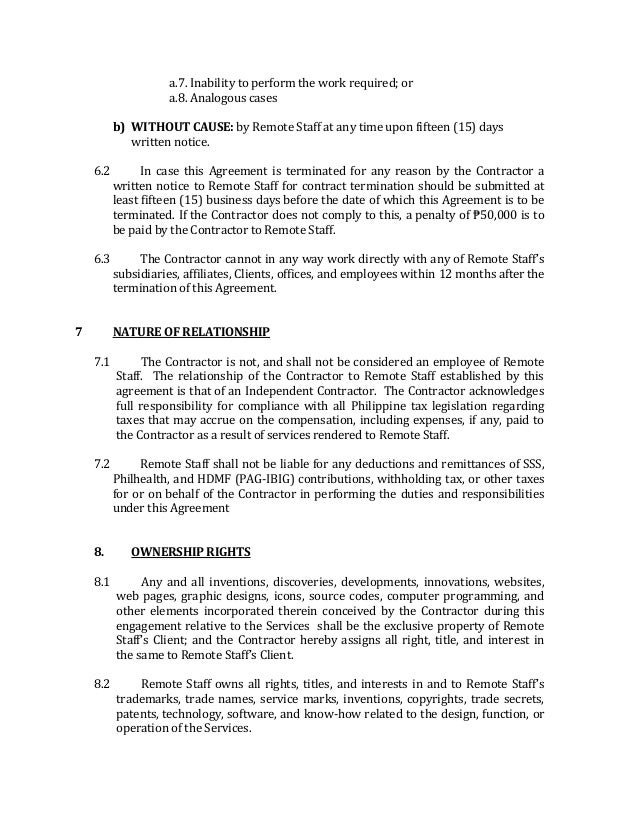

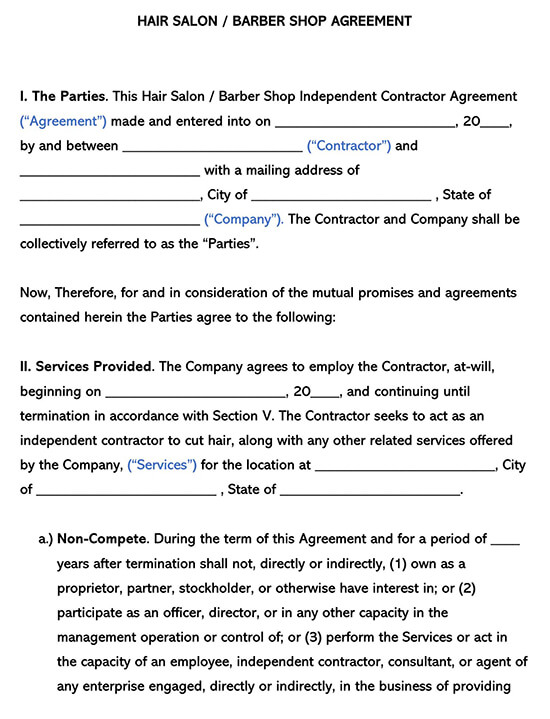

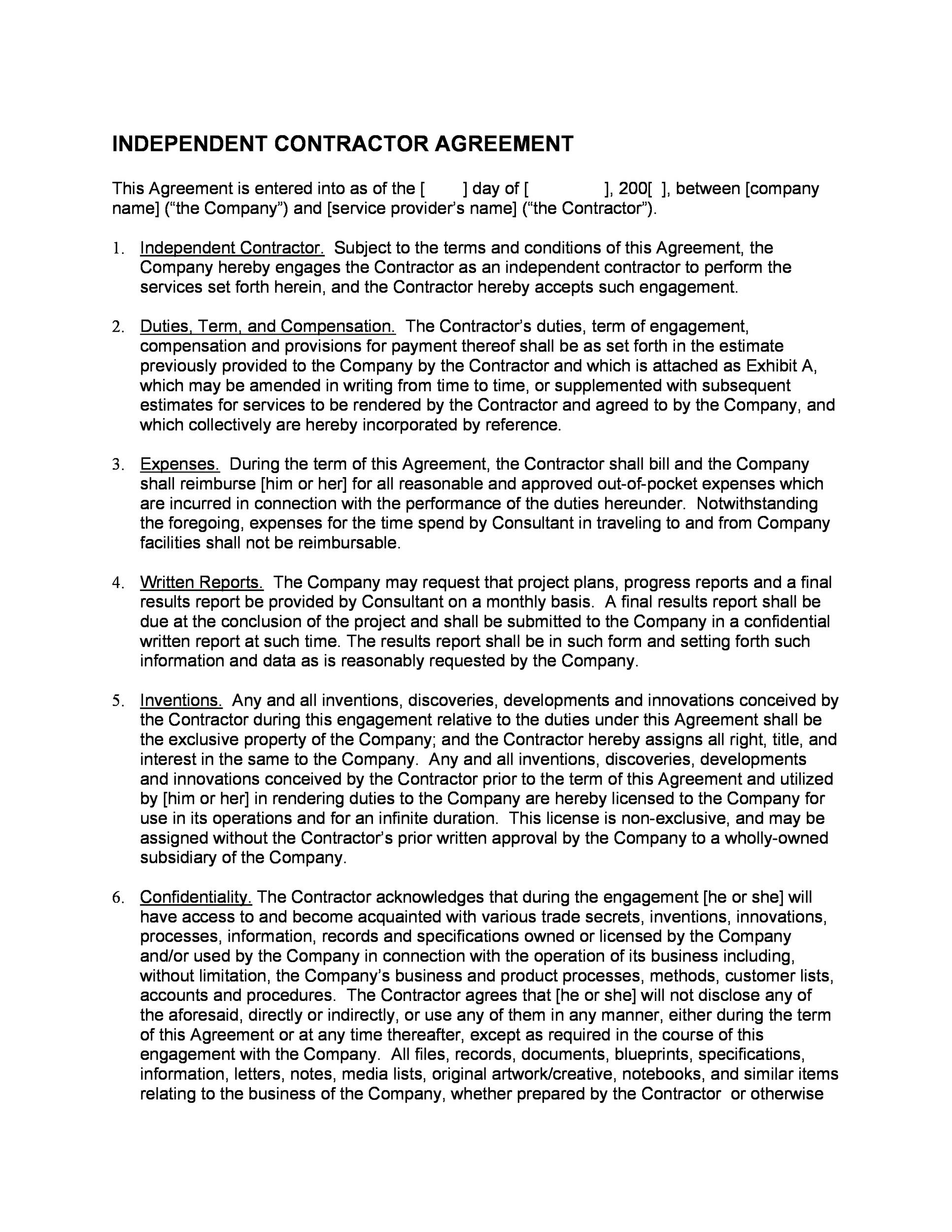

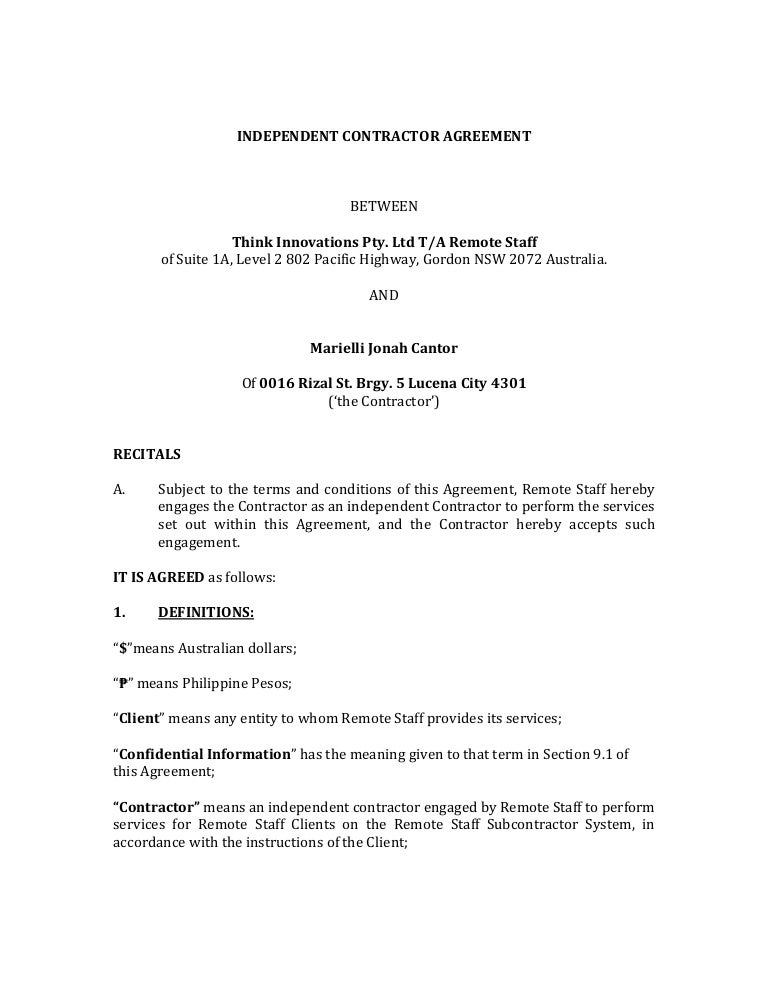

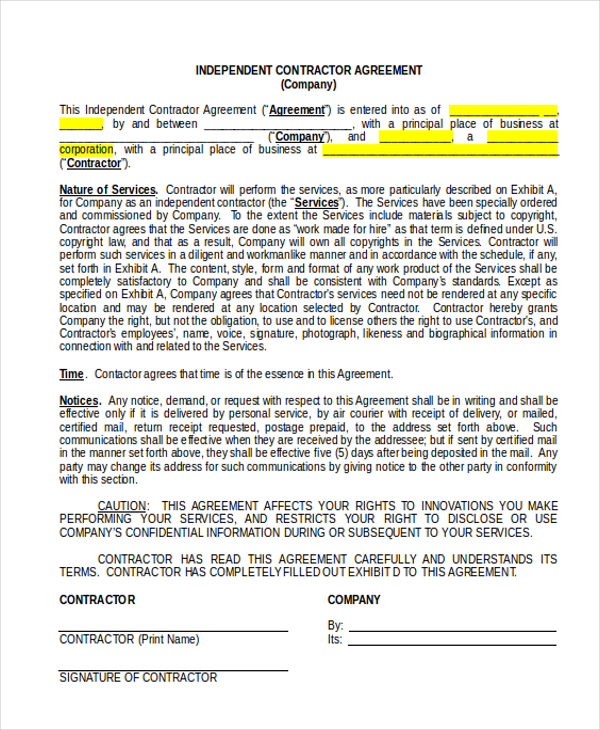

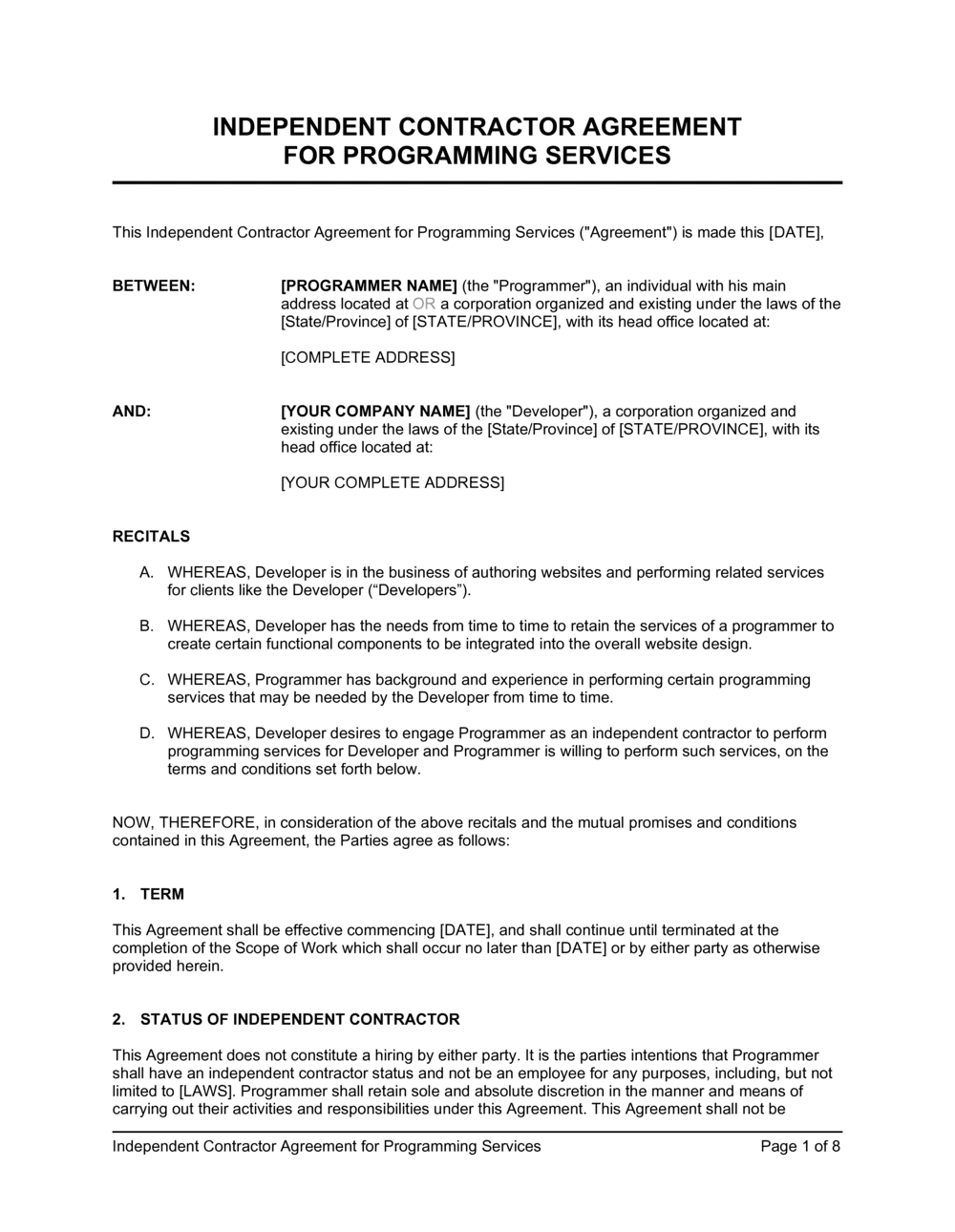

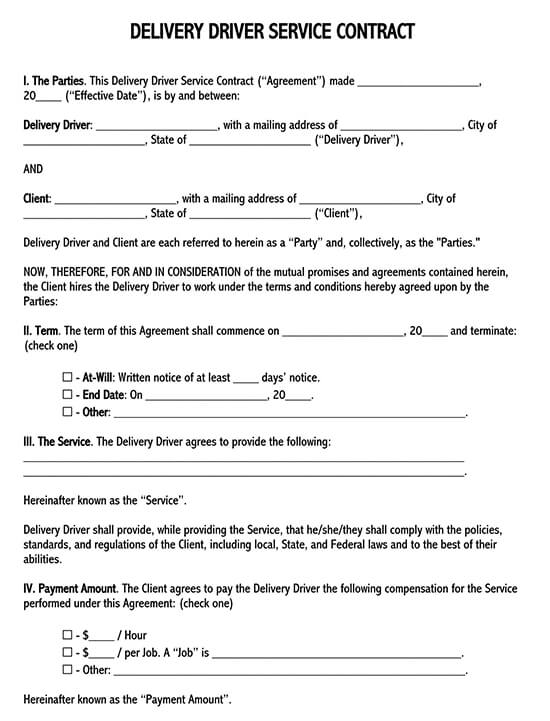

Contractor enters into this Agreement as, and shall continue to be, an independent contractor All Services shall be performed only by Contractor and Contractor's employees Under no circumstances shall Contractor, or any of Contractor's employees, look to Company as his/her employer, or as a partner, agent or principalCONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherThe Principal and Independent Contractor hereby agree that during the term of this Agreement and any extensions hereof, this agreement and the employment of the Independent Contractor may be terminated and the Independent Contractor's compensation shall be measured to the date of such termination (i) at will by either party with 90 (ninety

Agreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services;Provided however, the Services must be provided at theIndependent Contractor Status The parties acknowledge that Contractor is and shall at all times be an independent contractor and not an employee of the Companies The parties agree a The Companies shall have no right to direct the manner in which Contractor performs the Services;

Benefits of a 1099 Nurse Practitioner When working in the role of an independent contractor, the nurse practitioner can demand more money The employer doesn't have to shoulder the tax burden, so should be able to pay the NP quite a lot more Since the NP also won't receive any benefits as a 1099 contractor, the NP's pay should make upJun 04, 18 · This form is not filed with the IRS but is required to be held by the payer of services for at least four (4) years IRS Form 1099 – To be filed with the IRS at the end of the year if the payer paid an independent contractor $600 or more Must beCompany and Independent contractor agree as follows 1 The Company hereby employs the independent contractor as an independent contractor, and the Independent contractor hereby accepts employment 2 The term of this Agreement shall commence on _____ After the first thirty

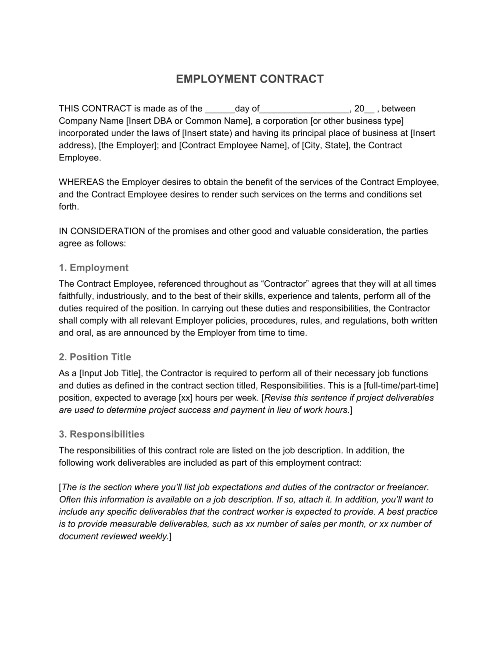

Employment Contract Definition What To Include

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

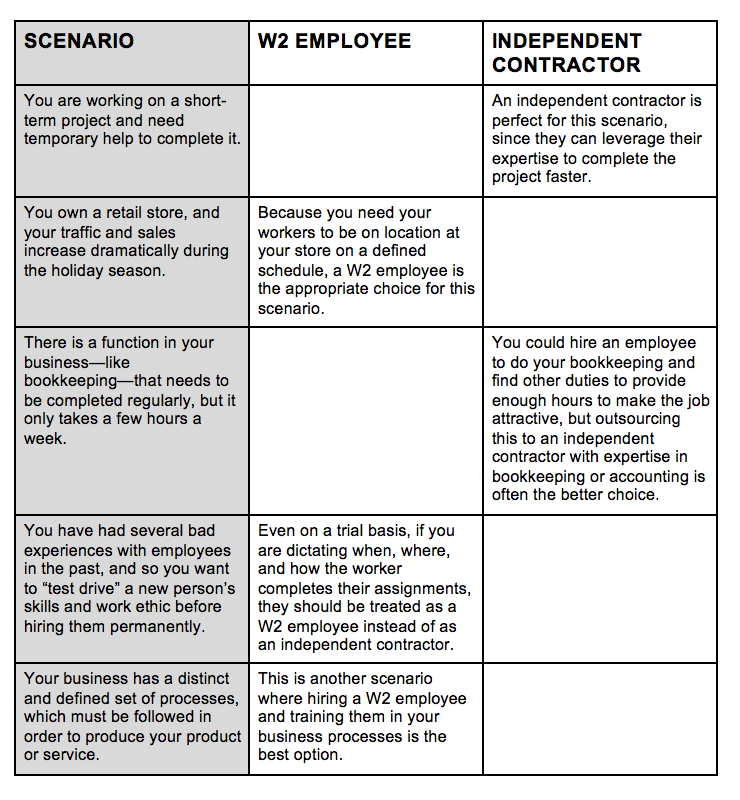

A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the likeTherefore any LLC or individual name will need to receive a 1099Misc The filing requirement threshold for a 1099Misc is $600 So if any contractor is below that amount you are not required to file a 1099Misc If you are unsure and want to file, its always better to get the W9 filled out and file a 1099MiscAug 27, 19 · employment relationship and an independent contractor relationship succinctly Both relationships were regarded as a bilateral contract of letting and hiring, either of services or of a piece of work In the employment relationship (letting and hiring of services), the employee (lessor) placed their services at the disposal of the employer (lessee)

17 Printable Independent Contractor Agreement California Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

1099 Vs W2 Employee How Are They Different

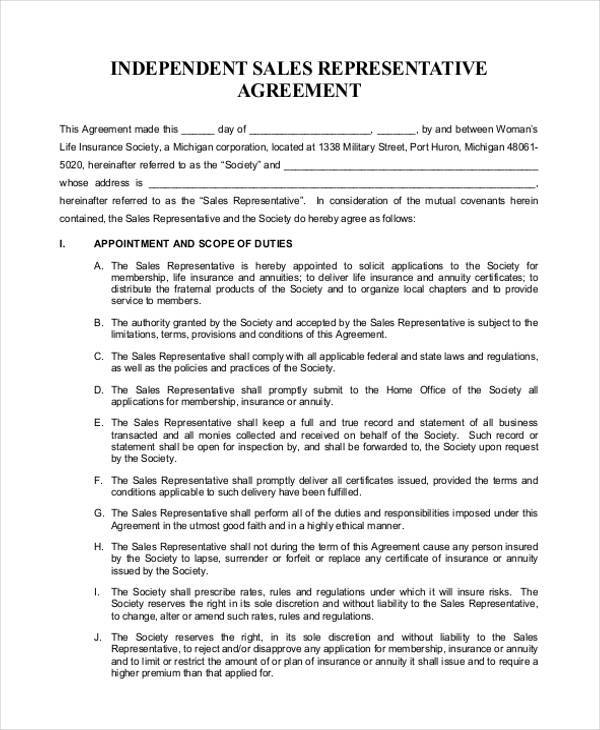

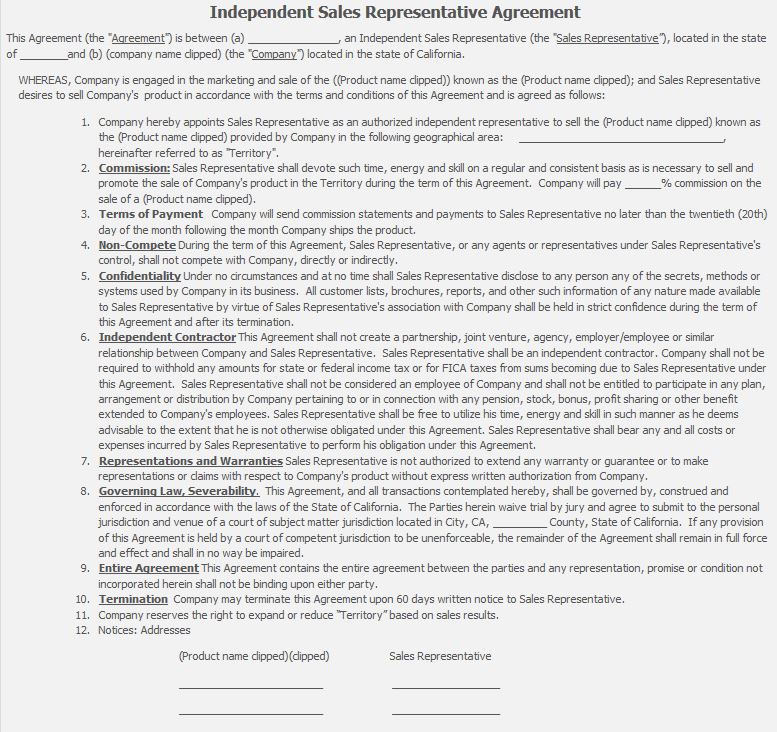

Jul 07, · The contract with the independent sales rep is the best way to show that the person is an independent contractor The document should state that the sales rep is a contractor and spell out what he or she does, how often and how much he or she is paid, and provide a definition of how commission is paid out, such as getting 15 percent of each saleAn independent contractor agreement is a legally binding, written agreement that details the contractor relationship the business relationship between a payer/hiring company and an independent contractor;Startups can streamline the hiring process with an independent contractor by using a standardized agreement In using an independent contractor agreement template, you ensure that everyone at your startup who is part of the recruitment process uses a consistent and legally defensible document

Free Printable Independent Contractor Agreement Template Templateral

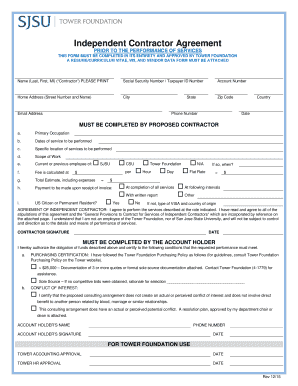

Independent Contractor Agreement Example Simple Template Addictionary Form

The worker does not have the option of choosing independent contractor status, nor will a signed contract or agreement convey independent contractor status if the common law factors indicate otherwise Misclassification can result in employer liability for state and federal tax withholding, social security and Medicare withholding, stateAnd Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent ContractorThe agreement should state that the independent contractor, not the employer, is responsible for withholding any necessary taxes In addition, have the independent contractor submit invoices

Free Printable Independent Contractor Agreement Template Templateral

50 Free Independent Contractor Agreement Forms Templates

A simple agreement between a company and an independent contractor, independent contractor agreement is usually used when a company or an individual is hired to a short term task or a specific project Generally, the following things are revealed by a simple independent contractor agreementIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, Agreement Independent Contractor agrees that customers of the Company shall include, but are not limited to the followingMar 29, 21 · An independent contractor and anyone employing independent contractors will have to have a Form 1099MISC to report the gross payments received during the calendar year, and a 1099K to report any payments made through credit card payment companies

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Florida Independent Contractor Agreement 75 Main Group

Jul 08, · What is a 1099 Contractor?It is a crucial document for tax purposes The 1099NEC is needed to report how much income an independent contractor earns in a yearHiring independent contractors This setup is widely spread across all company sizes Hiring contractors has multiple benefits the possibility to employ foreign workers or shortterm workers, cost per employee savings, and the ease of contractor relationships Although it's the easiest to set, it can lead to tax evasion charges and IRS audits when local laws and different setups for

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

Self Employed Vs Independent Contractor What S The Difference

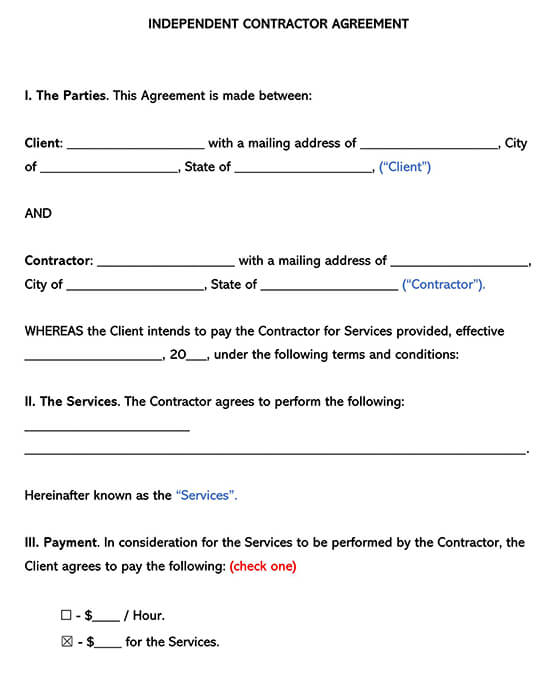

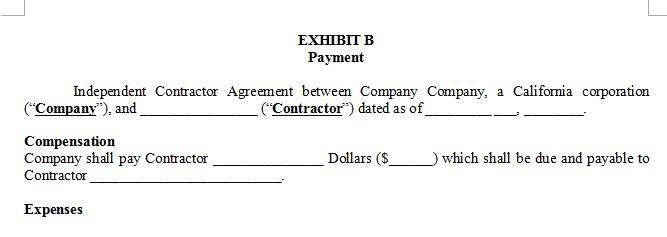

Exhibit 1011 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of February 1, 12 (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor")Each of ViSalus and Contractor are sometimes referred to individuallyMar 15, 21 · An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreementsOrder and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance

Independent Contractor Agreement Full Time

Independent Contractor Form Template Awesome Independent Contractor Resume Sample New 1099 Form Day Planner Template Letter Templates Lettering

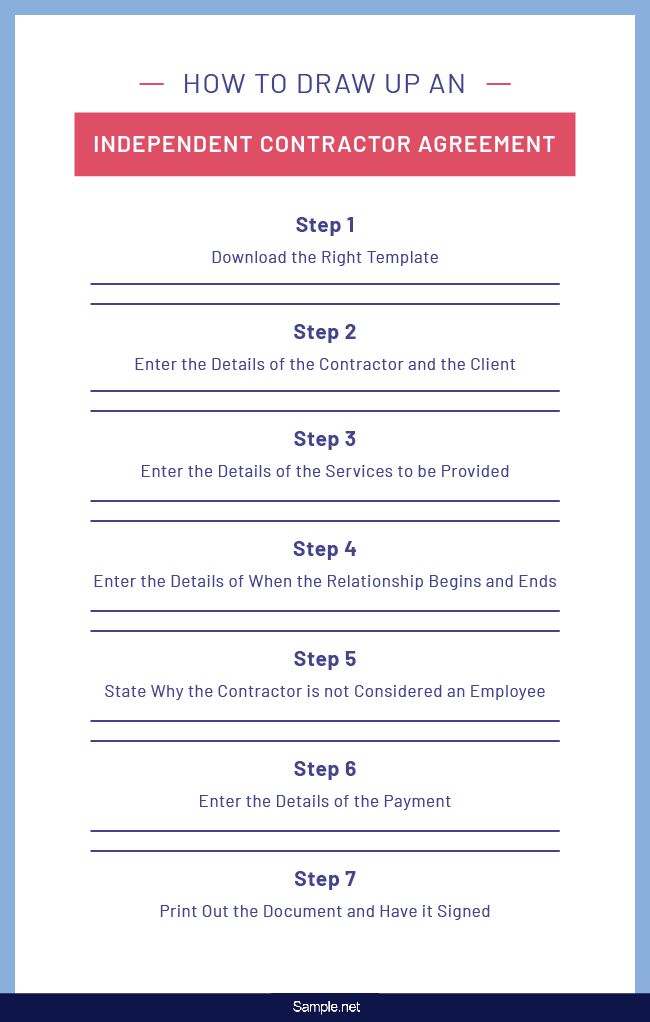

4 D) It is agreed that additional deductions is setup per Commercial Motor Vehicle at the time of the agreement,as followed below 1 INDEPENDENT CONTRACTOR authorizes CARRIER to withhold $ US dollars per week for cargo / liability insurance regardless of operation or not 2 INDEPENDENT CONTRACTOR authorizes CARRIER to withhold $ US dollars per weekApr 14, 21 · People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these people are independent contractors or employeesOct 31, · The article above works as a complete guide to writing an independent contractor agreement It is a fairly simple process, which is legally binding Simply have the independent contractor fill in a 1099 agreement, list all the terms of the contract such as monetary compensation, the time frame within which the work is to be completed, and the

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

50 Free Independent Contractor Agreement Forms Templates

Apr 15, 21 · The independent contractor must also have sufficient time to carefully review the content you have provided in Articles I to XXIV If this document is an accurate representation of the independent contractor`s intentions, he or she should consolidate the agreement by signing the "Contractant`s Signature" lineIndependent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows Check all that applyAgreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply)

Independent Contractor Agreement Full Time

50 Free Independent Contractor Agreement Forms Templates

An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSFor example, an agreed percentage of salary instead of vacation benefits and allowances, or certain expenses such as travel and meals If the payment to the independent contractor is more than $600 in a calendar year, the client must submit Form IRS 1099 to the Internal Revenue Service (IRS) if they pay their taxes on April 15Arizona Employment Arizona Independent Contractor Agreement Independent Contractor This is a contract to be used by an independent contractor The independent contractor uses this type of contract before beginning a job with either a subcontractor and/or Owner of a parcel of land This form is available in

8 Printable Independent Contractor Agreement Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Independent Contractor Agreement Simple Construction Contract Contract Template Independent Contractor

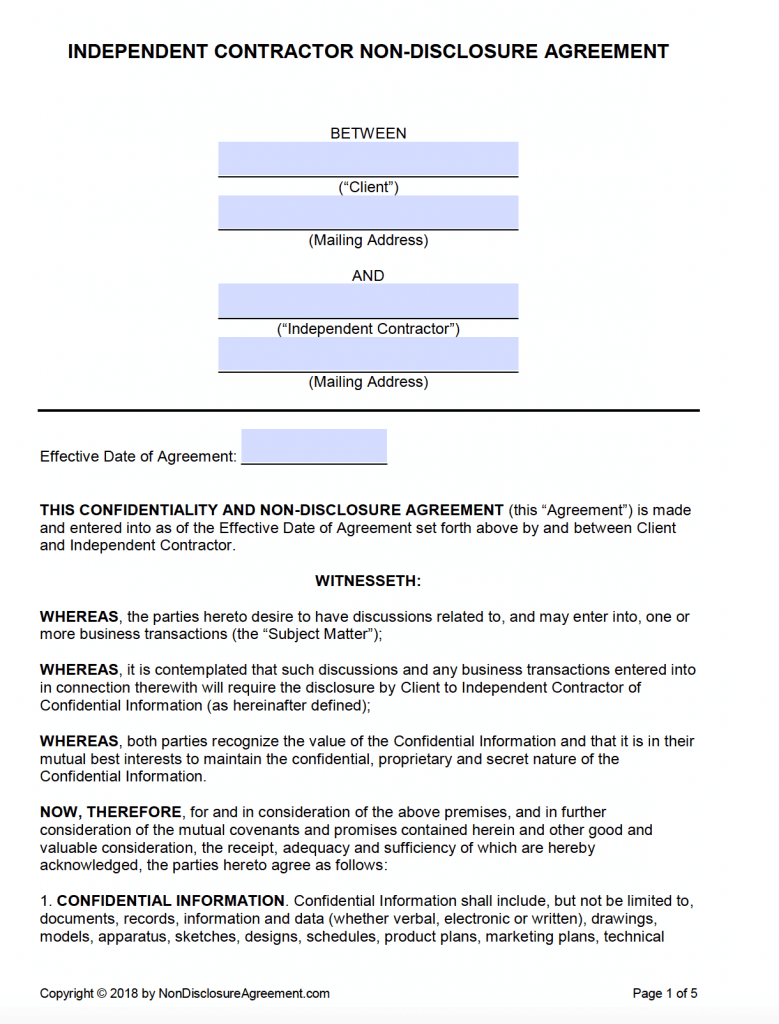

The independent contractor nondisclosure agreementis intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound toAn independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative namesGet The Complete Presentation https//landingpageswebsiteleadpagesnet/agilitypresentationtophrissuesof14/Call (619) For More Information

1099 Employee Difference Matters Hire Caregiver 1099 Employee Contract Template Insymbio

Freelance Contract Create A Freelance Contract Form Legaltemplates

MYTH #5 I am an independent contractor because I signed an independent contractor agreement FACT #5 Signing an independent contractor agreement does not make you an independent contractor MYTH #6 I am not on the payroll, so I am not an employee FACT #6 Even if you are not on the payroll, you may still be an employeeFree Independent Contractor Agreement Answer a few simple questions Print and download instantly It takes just 5 minutes An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and independent contractor No employer/employee relationship is created, and neither party is authorized to bind the other in any way Contractor

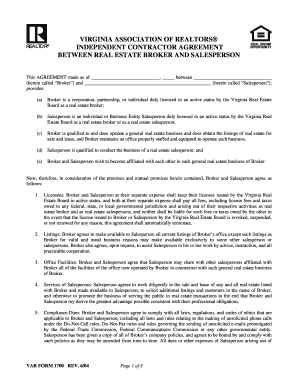

Fillable Online Sjsu Independent Contractor Agreement Form Fax Email Print Pdffiller

Free Independent Contractor Agreement Templates Word Pdf

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeAn Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed Outlines payment details and the length, or term of the contract Sets out other terms of the working relationship, such as ownership of intellectual property

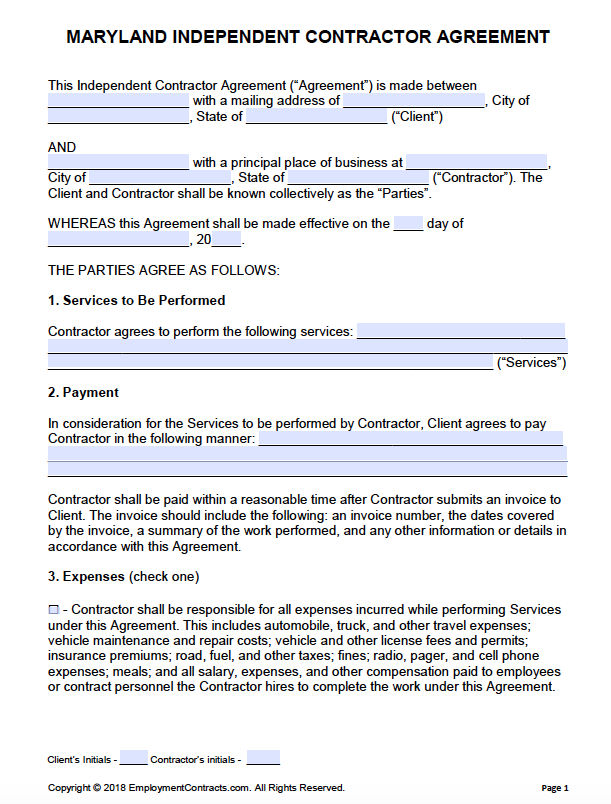

Free Maryland Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement Free To Print Save Download

Sample Independent Sales Rep Agreement Medcepts

Use A Nda With Independent Contractor Agreements Everynda

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

Free Independent Contractor Agreement Template What To Avoid

Independent Contractor Agreement Free Download Docsketch

Independent Contractor Resignation Letter Template Free Pdf Google Docs Word Template Net Resignation Letter Letter Templates Day Planner Template

Independent Contractor Agreement Template Free Pdf Sample Formswift

Free Independent Contractor Agreement Templates Word Pdf

50 Free Independent Contractor Agreement Forms Templates

How To Pay Contractors And Freelancers Clockify Blog

Sample Real Estate Independent Contractor Agreement Brilliant 1099 Contractor Agreement Form Models Form Ideas

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Free Washington Independent Contractor Agreement Word Pdf Eforms

Florida Independent Contractor Agreement 75 Main Group

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Full Time

Free Independent Contractor Agreement Template 75 Main Group

What Is A 1099 Contractor With Pictures

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Agreement Template Get Free Sample

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Templates Word Pdf

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Independent Contractor Agreement Template 75 Main Group

Free Florida Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

Free Printable Independent Contractor Agreement Template Templateral

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Contract Template The Contract Shop

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

34 Printable Sample Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Independent Contractor Agreement For Programming Services Template By Business In A Box

Free One 1 Page Independent Contractor Agreement Form Pdf Word Eforms

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contractors Contract Template

Independent Contractor Agreement Bestdox

Create An Independent Contractor Agreement Download Print Pdf Word

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Independent Contractor Consultant Agreement In Word And Pdf Formats

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Independent Contractor Agreement Texas Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Independent Contractor Agreement Template Approveme Free Contract Templates

Free Independent Contractor Agreement Pdf Word

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Independent Contractor Agreement In Word And Pdf Formats

Free Independent Delivery Driver Contract Templates Word Pdf

Independent Contractor Agreement Template Contract The Legal Paige

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Form California New Independent Contractor Agreement Template 50 New Independent Models Form Ideas

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

10 Printable Hair Salon Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template Download Wise

Florida Independent Contractor Agreement 75 Main Group

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Free Independent Contractor Agreement Template Download Wise

50 Free Independent Contractor Agreement Forms Templates

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Printable Independent Contractor Agreement Template Templateral

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

50 Free Independent Contractor Agreement Forms Templates

Freelance Contract Create A Freelance Contract Form Legaltemplates

Free Texas Independent Contractor Agreement Pdf Word

0 件のコメント:

コメントを投稿